Get the free n172

Show details

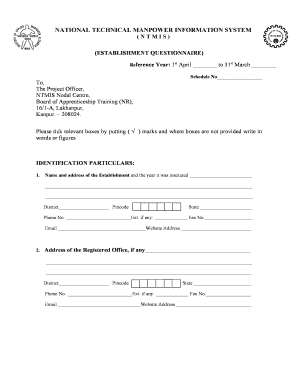

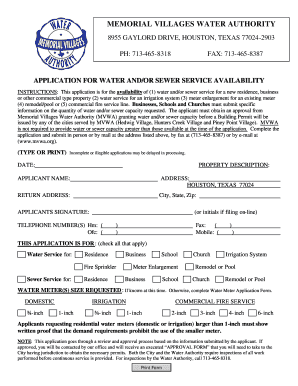

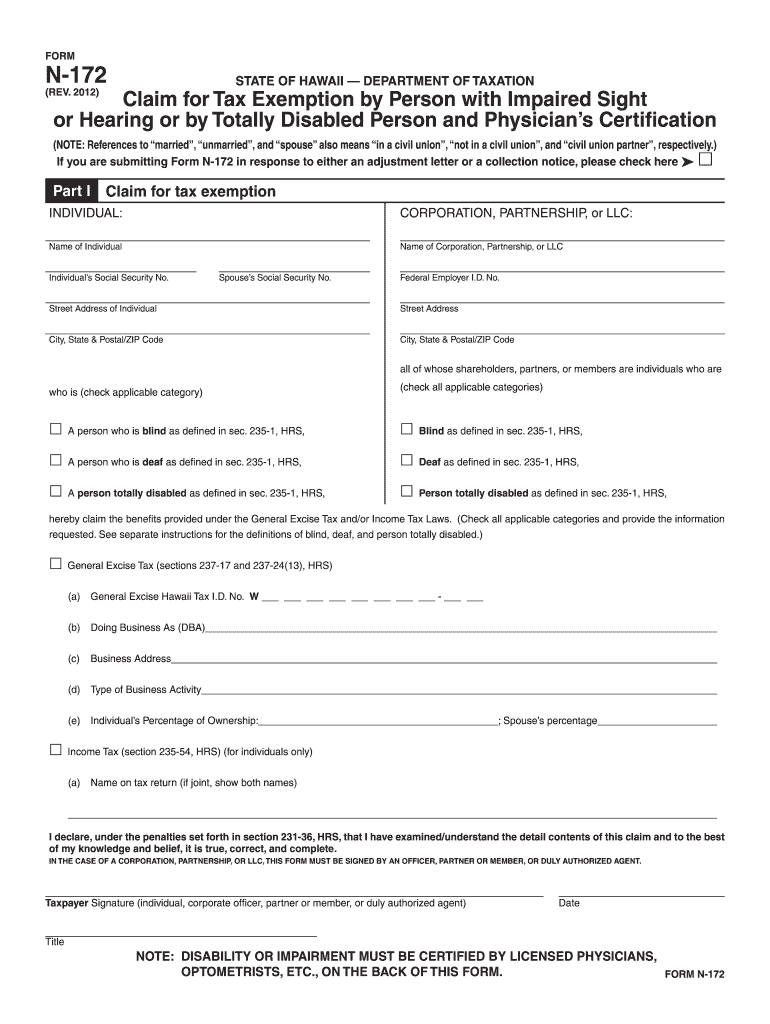

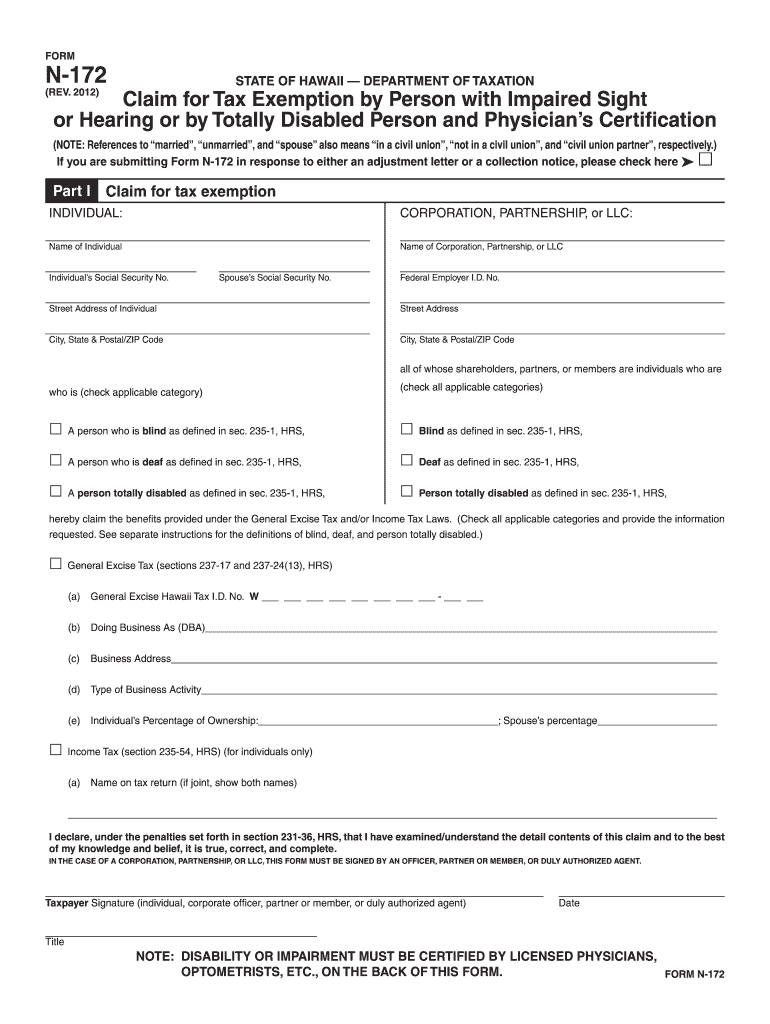

Clear Form (REV. 2012) N-172 Claim for Tax Exemption by Person with Impaired Sight or Hearing or by Totally Disabled Person and Physician's Certification (NOTE: References to married”, “unmarried”,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign n 172 form

Edit your eforms site pdffiller com site blog pdffiller com form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your n172 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit n172 form online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit n172 form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out n172 form

How to fill out form n 172:

01

Start by carefully reading the instructions provided on the form. This will help you understand the purpose and requirements of the form.

02

Gather all the necessary information and documents required to complete the form. This may include personal details, financial information, and supporting documents.

03

Begin filling out the form by entering your personal information accurately. Double-check the spelling and accuracy of all the details provided.

04

Follow the instructions on the form to provide the required financial information, such as income, expenses, or any other relevant data.

05

If there are any additional sections or fields on the form, make sure to complete them accordingly. Failure to complete all the necessary sections may lead to delays or rejection of the form.

06

Carefully review the completed form for any errors or omissions. Correct any mistakes before submitting the form.

07

Sign and date the form as indicated. Some forms may require additional signatures from other parties, so make sure to provide those if necessary.

08

Make copies of the completed form and any supporting documents for your records before submitting it.

09

Submit the form as instructed, either by mail, online, or in person. Retain proof of submission, such as a receipt or confirmation, for future reference.

Who needs form n 172:

01

Form n 172 may be needed by individuals or businesses who are required to report certain financial or tax-related information to the relevant authorities.

02

This form may be mandatory for individuals or entities in specific industries or professions, or for those meeting certain financial thresholds.

03

The purpose of form n 172 and the entities required to use it may vary depending on the country, government agency, or regulatory body involved.

04

It is important to consult the specific guidelines or regulations provided by the issuing authority to determine who needs to fill out form n 172 and under what circumstances.

Fill

form

: Try Risk Free

People Also Ask about

What is the disability exemption in Hawaii?

BLIND, DEAF OR TOTALLY DISABLED If you have impaired sight, hearing or are totally disabled, you may file a claim on Form 19-75 for a $50,000 real property tax exemption on properties you own in the County of Hawaii. This claim is in addition to the regular home exemptions.

What is the Hawaii form 301?

Purpose of Form N-301. — Use this form to make a tax payment if you will have a balance due when you file Form N-20, N-30, N-35, N-40, N-66, N-70NP, or N-310. An extension of time to file your income tax return will not extend the time to pay your income tax.

What form do I use for Hawaii estimated taxes?

1040ES. Estimated Tax for Individuals. Estimated tax is the method used to pay tax on income that is not subject to withholding (for example, earnings from self-employment, interest, dividends, rents, or alimony).

What is the disability exemption for Hawaii general excise tax?

If you are blind, deaf or totally disabled and your impairment has been certified, submit Form N-172 prior to filing your return in order to claim the disability exemption of $7,000.

What is the tax form for non resident Hawaii?

Hawaiʻi nonresidents or part-year residents should file state Form N-15. A completed copy of the federal return must be attached to the Form N-15.

What form is Hawaii estimated tax payments?

1040ES. Estimated Tax for Individuals. Estimated tax is the method used to pay tax on income that is not subject to withholding (for example, earnings from self-employment, interest, dividends, rents, or alimony).

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find n172 form?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the n172 form in a matter of seconds. Open it right away and start customizing it using advanced editing features.

How do I edit n172 form on an iOS device?

Create, modify, and share n172 form using the pdfFiller iOS app. Easy to install from the Apple Store. You may sign up for a free trial and then purchase a membership.

How do I edit n172 form on an Android device?

You can make any changes to PDF files, like n172 form, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

What is form n 172?

Form N-172 is a specific form used in the context of certain tax filings or declarations, often associated with tax-related requirements in various jurisdictions.

Who is required to file form n 172?

Individuals or entities that meet specific criteria defined by the tax authority may be required to file Form N-172, typically those with certain income levels or types of financial activity.

How to fill out form n 172?

To fill out Form N-172, follow the instructions provided on the form, ensuring that all relevant fields are completed accurately, including your personal information, income details, and any deductions or credits.

What is the purpose of form n 172?

The purpose of Form N-172 is to report specific information to the tax authorities, which may be necessary for calculating tax liability, ensuring compliance, and providing insights into financial activities.

What information must be reported on form n 172?

Form N-172 typically requires reporting personal identification details, income sources, deductions, credits, and any other relevant financial information as specified in the form's instructions.

Fill out your n172 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

n172 Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.